Intro to Revenue Recognition: GAAP Principles

Additionally, this method may provide a more timely indication of a company’s performance when compared to the accrual basis of accounting. As a result, many businesses use the accrual basis of accounting, which records revenue when it is earned, regardless of when the customer pays. While this approach can smooth out cash flow fluctuations, it does not provide as accurate a picture of revenue as the completed service method. Ultimately, the best method for recording revenue will depend on the specific needs of the business. The concept of realization is interpreted and applied differently across various accounting frameworks, reflecting the diverse regulatory environments and economic contexts in which businesses operate.

- Fortunately, revenue recognition automation services like RightRev exist to take this burden off your accounting team’s plate.

- In this second example, according to the realization principle of accounting, sales are considered when the goods are transferred from Mr. A to Mr. B.

- It is important to note time of sale recognition is not commonly applicable in today’s world of accounting in accordance with US GAAP.

- Performed correctly, revenue recognition follows several generally accepted accounting principles (GAAP) that we will discuss in more detail below.

Strategies to overcome the challenges when getting revenue recognized

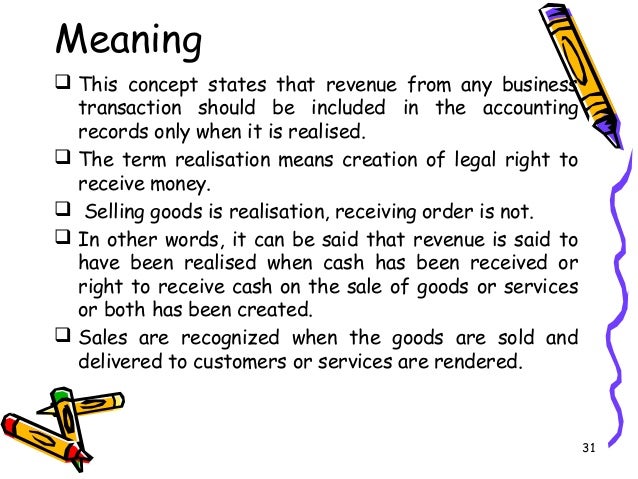

The core principles of the realization concept are that income should be recognized when it is earned and expenses should be recognized when they are incurred. The realization concept is the idea that revenue should only be recognized when it is earned, which typically happens when goods or services are transferred to the buyer. This means that revenue should only be recognized once the seller has provided the goods or services to the buyer, and the buyer has accepted those goods or services.

What is your risk tolerance?

The realization concept is an accounting principle that dictates when revenue should be recognized. According to this principle, revenue should only be recognized when it is realized or realizable and earned. Companies may need to provide an estimation of projected giftcard revenue and usage during a period claim child benefit based on past experience orindustry standards. Ifthe company determines that a portion of all of the issued giftcards will never be used, they may write this off to income. Revenue recognition is generally required of all public companies in the U.S. according to generally accepted accounting principles.

Challenges in revenue recognition

These frameworks ensure that public sector financial statements provide a true and fair view of the entity’s financial position, enabling better accountability and transparency. The revenue recognition principle of ASC 606 requires that revenue is recognized when the delivery of promised goods or services matches the amount expected by the company in exchange for the goods or services. The completed contract method recognizes revenue when a contract is completed, and the risks and rewards of ownership transfer to the customer.

IFRS focuses on the transfer of control rather than the transfer of risks and rewards, which is a key aspect under GAAP. This means that under IFRS, revenue is recognized when the customer gains control of the goods or services, which may occur at a different point in time compared to GAAP. This distinction can lead to variations in the timing of revenue recognition, impacting financial statements and potentially influencing business decisions. Understanding the distinction between realization and recognition is fundamental for grasping the nuances of financial reporting. While these terms are often used interchangeably, they represent different stages in the accounting process. Realization refers to the actual process of converting non-cash resources into cash or claims to cash.

In this case, customers purchase and pay for games before they are released, and the company delivers the game to the customer upon its official release date. It also impacts a company’s profitability, liquidity, and solvency, thus influencing its valuation and creditworthiness. For example, if a company recognizes revenue prematurely, its profits will likely be overstated, whereas if it delays recognition, they will be understated. On September 1, 2023, a customer places an order for a set of books priced at $100.

The old guidance was industry-specific, which created a system of fragmented policies. The updated revenue recognition standard is industry-neutral and, therefore, more transparent. It allows for improved comparability of financial statements with standardized revenue recognition practices across multiple industries. Regulators know how tempting it is for companies to push the limits on what qualifies as revenue, especially when not all revenue is collected when the work is complete. For example, attorneys charge their clients in billable hours and present the invoice after work is completed. The materiality principle of revenue recognition dictates that a company discloses information that is material to the financial statements.

Certain businesses must abide by regulations when it comes to the way they account for and report their revenue streams. Public companies in the U.S. must abide by generally accepted accounting principles, which sets out principles for revenue recognition. This prevents anyone from falsifying records and paints a more accurate portrait of a company’s financial situation.